Standard Bank overcharges on all iTunes, Steam and Playstation Network purchases

After my previous posts about Standard Bank overcharging on all iTunes, Steam and PSN purchases which surfaced during my No Man’s Sky refund issue, I found that with the help of the Payments Association of South Africa Standard Bank of South Africa charged a 2,5% conversion fees on a number of e-commerce sites including iTunes, Steam and Sony Playstation Network. There are probably other sites as well, but Standard Bank has declined to provide me with a list.

It really becomes interesting when you follow the chain of events:

- 26th August 2016: I lodged a query with SBSA ([email protected] / [email protected]), enquiring about why a purchase of R899 was settled at R921.48 two days after the purchase.

- 30th August 2016: SBSA responds that the transaction is international and as such a currency conversion fee was applied. A Conversion Fee Service Request was logged as I questioned the validity of it being an international transaction since the product was advertised in South African Rand and at no point during the purchase was such an extra fee mentioned.

- 08th September 2016: While going through SBSA statements back to March I found further transactions with “currency conversion charges” and sent a follow up email to SBSA.

- 08th September 2016: The case number PASA-Pasa.FID3936 is allocated with PASA for investigation

- 20th September 2016: My Private Banker sends me an email telling me: “The systems are charging Currency Conversion because this is not a local merchant, but the charge is not correct because the transaction originated in our home currency.“. SBSA refunds me currency conversion charges for Playstation Network, Steam and iTunes purchases. I ask SBSA for clarification if this applies to only me or other customers and how SBSA will remedy the situation. My email remains unanswered.

- 26th September 2016: Follow up email to SBSA with additional questions. SBSA responds and now requests information I originally provided on 26th August. I provide all the details again, and my email remains unanswered.

- 30th September 2016: I sent another follow-up email to my email from 26th September which still remains unanswered.

- 4th October 2016: SBSA responds to my 26th September email with “Kindly note that the initial response you were provided below was incorrect. … We can confirm that the currency conversion fee was correctly applied in this case as Playstationnetwork is an International Merchant situated in Great Britain.“

- 5th October 2016: I escalate this to PASA and am told that I will receive a formal written response from SBSA by 13th October 2016.

- 13th October 2016: Do you hear the crickets chirping? No response from SBSA.

- 18th October 2016: Another follow-up email about the promised feedback I was supposed to get on 13th October. This email also remains unanswered.

- 25th October 2016: Another follow-up email. PASA then re-escalates to SBSA with the following message “Dear XXX! The below has reference. The matter has been given to Standard Bank for an official response, please can Standard Bank do so.“

- 27th October 2016: Standard Bank’s Head of Debit Card Issuing, South Africa responds:

Good day Mr Naschenweng. Thank you for bringing this to our attention.These merchants are Acquired internationally, and therefore the transaction is processed internationally, and hence the fee is applied, as it is recognised as an international transaction. However the fee naming convention needs to be revisited on these specific transactions and we are looking into how we correct this.Please accept my apologies for any frustration caused.

- 27th October 2016: I reply with a length email, questioning how SBSA can first claim that this was no issue, then issue refunds and then back-tracking that all is working as intended. Based on the above feedback, Standard Bank believes that changing the naming of the fees will fix the problem for good.

- 31st October 2016: Another email from someone with the name Somayya from Standard Bank (the email did not carry an official signature/designation of the person replying):

Please be advised that Standard Bank has officially responded to the customer regarding this matter.

- 31st October 2016: Complaints filed with the following industry bodies:

- 31st October 2016: Standard Bank legal department has confirmed that they will not resolve the issue and my refund was a “gesture of goodwill”

- 4th November 2016: The Ombudsman for banking services confirms that they are investigating the lodged complaint.

- 7th November 2016: Feedback from PASA:

With reference to our last e-mail on Friday, we have engaged with the Card Schemes to clarify our understanding of this matter, as far as treatment of fees by different banks.

From a payment processing and rules point of view, cross border transactions (as in this instance) attract additional fees levied by the Card Schemes to the respective Issuing Banks. Fees levied to the cardholder resides in the domain of the bank/cardholder relationship and are governed by the relevant terms and conditions between such parties. These fees are not prescribed or enforced by the Card Schemes or PASA.

There has been no abnormalities w.r.t the processing and treatment of the transaction in question, and PASA cannot influence or comment on what fees are applied by Standard Bank, or any other bank to their cardholders.

Lastly, with regards to your reference to inconsistent treatment between various banks, we reiterate that these fees are between the bank and its cardholder and are not prescribed by any payments related rules or regulation.

- 7th November 2016: The National Consumer Commission confirms investigation of my case against Standard Bank.

While this matter is still ongoing and I am in the process of opening formal complaints with the Financial Services Board, the National Consumer Tribunal and other regulatory bodies, it must be noted that only Standard Bank seems to charge those additional 2.5% fees. The really big issue is that the bank refuses to provide any transparency or acknowledgement that this process is wrong.

From the consumer perspective I will now demonstrate how a consumer will perform a purchase of an advertised product and will possibly never realise that a surcharge was charged days later. The reason for this is that the stores mentioned advertise their products in South African Rands and the purchase completes with the same amount. Was is not transparent is that the purchase is only a credit card authorisation which will settle at a different amount days later.

Standard Bank refunds surcharges, calls it an error

I mentioned before that on the 20th September 2016, Standard Bank sent me the email below with a summary of the surcharges and acknowledgement of the mistake as well as the refund of the surcharges:

As much as Standard Bank wants to deny any wrong-doing, I must point out that the above amount of R101.63 was refunded to my card on 16th September:

![]()

Where it now becomes unethical is that the bank has now changed opinion and insists that the 2,5% are legitimate charges. I do not think that in the eyes of the Consumer Protection Act or even the Financial Services Board such conduct is accepted as it deceives the consumer about the original purchase price. The problem is far bigger than my R101.63 in refunds, as those charges have been passed on to every Standard Bank customer purchasing on iTunes, Playstation Network, Steam and possible other stores since at least 2014. The issue seems to also only apply to Standard Bank and none of the other South African banks (at least I could not find any evidence or feedback from other consumers).

Standard Bank backtracks and calls it a “naming convention issue”

Once I requested from SBSA to answer a number of questions (including how the bank will communicate this issue to other customers and how they will refund affected customers), the bank remains silent. After a number of escalations, I am told by PASA that the bank will reply formally by the 13th October 2016. The bank’s head of Debit Card issuing only responds on the 27th October, calling the overcharges a “fee naming convention issue”:

My reply requesting further clarification remains unanswered for a few days until the Manager of Legal and Media responds:

Testing the “fee naming convention issue”

Since Standard Bank in one of the emails mentioned that the issue of the system incorrectly charging a conversion fee is being addressed, I thought it would be relevant to test this again and document all screenshots to ensure that I have not missed the vital part where Sony Playstation Store or SBSA would notify me with a “Please note this is an international transaction and you will be charged an additional 2,5% currency conversion fee”.

On 28th October I tried another purchase to document the customer experience and how Standard Bank’s claim is wrong. For this test, I chose to purchase in game-currency for the PS4 game, Destiny, from the South African Playstation Network store. Games for the PS4 are sold digitally via the PSN store in the respective country (noticeable via the “en-za” in the URL) and advertised in the country’s home currency:

If you are unfamiliar with how the Sony Playstation Network Store works: You need to have a Playstation and a Playstation account. In order to purchase via credit card you can only load a credit card issues in the country for the specific Playstation store. For example: you can not use a South African credit card to purchase content on the US Playstation store. Likewise, you can not use an international card on a South African Playstation Network Store unless the issued card’s address details matches the country of the PSN registration.

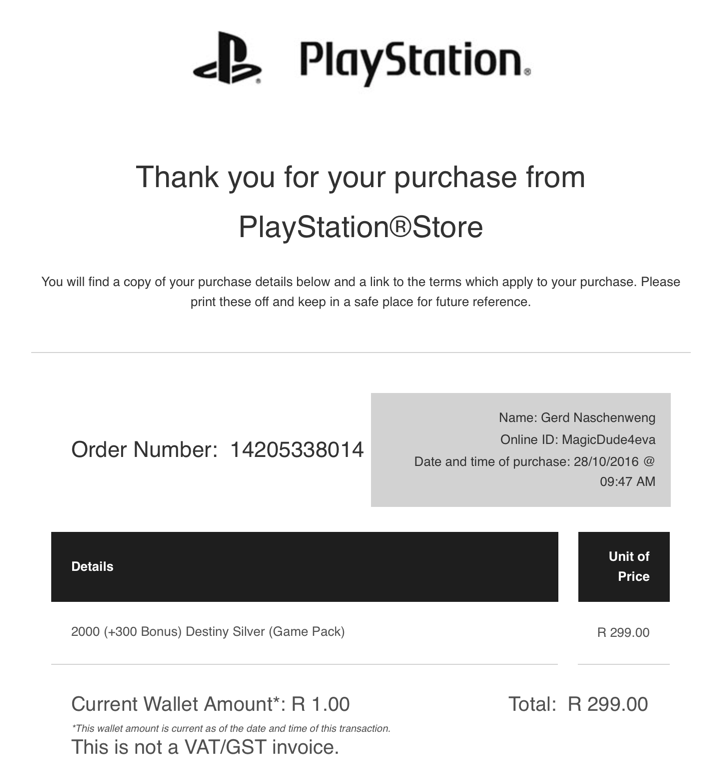

For this test-purchase I will pre-load my Sony Playstation Network account with R 300.00 and then purchase “Destiny Silver” (an in-game currency) for the advertised price of R 299.00. I have documented the purchase steps below and you will notice that all prices are advertised in the local South African currency and at no point is there any mention of currency conversion surcharges:

During checkout, the same amount of R 299.00 is displayed:

The purchase confirmation screen also shows R 299.00:

Most of my purchases happen with a pre-funded wallet. In those cases I will preload a set amount into my PSN wallet and I then have the convenience to purchase up to the available wallet amount without having to do another credit card payment. This is useful for micro-transactions where purchases are less than R50. For the in-game currency purchase, I preloaded my wallet with R 300.00 via the South African Sony Playstation Network Store:

The R 300.00 transaction also shows up as an outstanding authorisation on my Standard Bank account

![]()

… and I immediately receive a SMS confirmation for the purchase:

Once the wallet funding is complete, I proced to finalise the purchase of the in-game currency and the South African Sony Playstation Network Store then confirms my purchase on the website:

and also via email:

In all of the above you will have noticed that at no point in time is there any mention of a 2,5% “conversion surcharge”.

Standard Bank settles with a 2,5% surcharge

From the above screenshots you will notice that the bank does an authorisation of R 300.00 against my Visa credit card. At that point in time any consumer would have felt that the transaction is concluded, but not so with Standard Bank. Several days later, the R 300.00 purchase will settle against my card with R 307.50:

From the above you will see that I am actually charged R 307.50 for a R 300.00 wallet funding. Nothing would be wrong with such a charge if the Playstation Network Store would advertise this upfront.

Are other banks charging a “currency conversion fee”?

When I contacted all other banks directly, none of the banks where prepared to provide feedback to my query. I then relied on feedback from regular consumers and I can certainly confirm that at least First National Bank and Grindrod do not charge additional fees as confirmed by one other user:

I’ve just had a quick look at my transaction history, and I’m not charged any additional transaction fee (I bank with FNB) for these types of transactions.

No conversion fee is applied either on my Grindrod account.

Another user on sagamer.co.za:

Just to confirm, I bank with ABSA and checked my statements now. No extra fees.

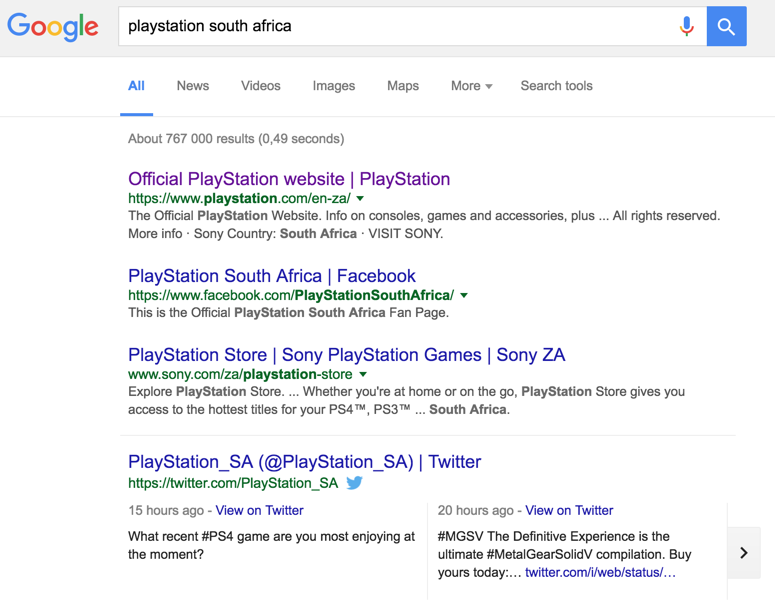

Is the Sony Playstation Store “South African”?

Based on feedback from Standard Bank, the store is an international merchant and as such the bank has every right to charge a conversion fee. I also raised this issue with both Ster Kinekor (the official distributor for Sony Playstation products and services in South Africa) and PartServe (the official warranty provider for Sony Playstation products), but both companies declined to comment or provide feedback.

In one telephonic conversation I was told that the Sony Playstation Network Store is not South African and that there is no official Sony Playstation presence in South Africa. A Google search however shows a different view:

PASA and Visa respond to currency conversion and 3d-secure

PASA has been extremely helpful in dealing with this issue and for clarity it is prudent to also record their and Visa’s responses

PASA answering the question why 3d secure is not used (9th September):

It is such a pleasure when consumers are aware of the requirements that must be applied. 3D Secure is Mandatory within SA.

Most online stores get around the 3d-secure requirement by processing transactions outside of South Africa and enforcement seems to be impossible. It is still beyond me that online stores exist who do not comply or bypass 3d secure requirements.

PASA commenting on the issue of the currency conversion charges (10th September):

Thank you for the updated information and providing the card information in the two emails.

PASA’s mandate is only for those transactions initiated and processed in SA. The view will be that such entity operating outside SA and display ZAR as the value should display the implication of conversion as well. But lets see what comes out of the investigation.

Visa’s comment (12th September):

I believe I have traced one of the transaction(s) mentioned by the cardholder on 23 March 2016 and it seems to be multi-currency clearing which has occurred. This specifically means that although the acquirer is inter-regionally located, the transaction was billed in currency preference of the cardholder or based on the country of operation which in this case was ZAR. To respond to the question of the cardholder below, Verified by Visa (3D) does not influence currency conversion requirements (if applicable) or assessment fees levied to a bank for cross border transactions. Another question related to the query was that of the acquirer name which in this is case is WorldPay located in the United Kingdom.

It is my recommendation that the cardholder forward the issuer for an understanding of the circumstances under which a transaction would attract any commissions or additional fees when transacting with intra, or inter-regional acquired merchants

PASA relays message from Standard Bank about formal letter and a system fix to be implemented (5th October):

After receiving your email which PASA was CC in I contacted the PASA representative of Standard Bank to establish resolution.

Standard Bank has indicated that they are in the process to submit a formal letter to you but have to go through the necessary vetting internally which this letter should reach you by no later than 13 October 2016.

Additionally Standard Bank indicated that the matter raised by you has been thoroughly investigated and a fix implemented to their systems to rectify any such matter for future. Those consumers impacted has been identified and will be refunded by Standard Bank.

PASA is not aware of any such entity or Bank experiencing the same problem. However if raised by a consumer the matter will be immediately escalated to such a bank for investigation and resolution.

How to resolve this issue?

Since Standard Bank has refused to properly engage in this matter and does not see an issue with this issue and since Sony South Africa and Sony Europe refuse to comment, I am left with no other choice than reporting the issues to the various regulatory bodies.

Since the “currency conversion charges” seem to only apply to Standard Bank, I think that the bank should apply similar credit card processing as other banks have applied. From feedback so far, First National Bank does not seem to charge those fees.

I do not believe that the responsibility resides with Sony, iTunes or Steam as the charges are specific to one particular bank. However, if other banks levy similar charges, the stores should advertise the correct amounts prior to checkout and payment.

What about the refunds – Standard Bank backtracks?

Now this is the interesting part: On the 26th September 2016, Standard Bank admitted that the charges where incorrect:

The matter around the currency conversion amounts charged has been brought to my attention. I would to apologise on behalf of the Bank for the additional 2.50% on the transactions amount. The systems are charging Currency Conversion because this is not a local merchant, but the charge is not correct because the transaction originated in our home currency.

We have reimbursed you based on the below transactions that we have picked up. Total amount refunded R101.63

Let’s also not forget that on the 5th October 2016 PASA relayed feedback from Standard Bank that (1) a fix will be implemented and (2) “consumers impacted has been identified and will be refunded”:

Recent Comments